who pays sales tax when selling a car privately in illinois

Who pays sales tax when selling a car privately in illinois. Safety Administrations NHTSA odometer disclosure.

How Do I Sell My Car Illinois Legal Aid Online

Saying a SALE is a GIFT is FRAUD.

. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

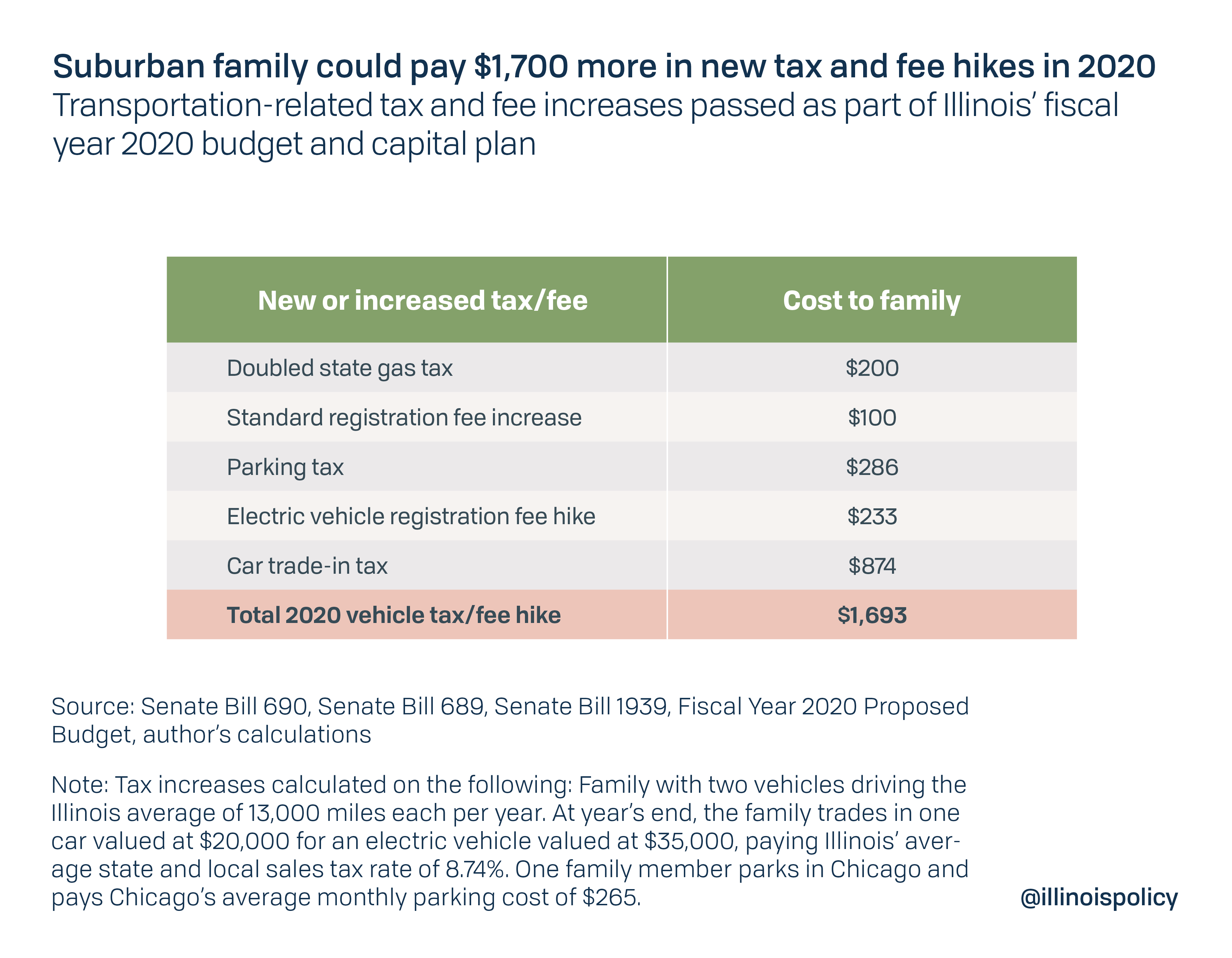

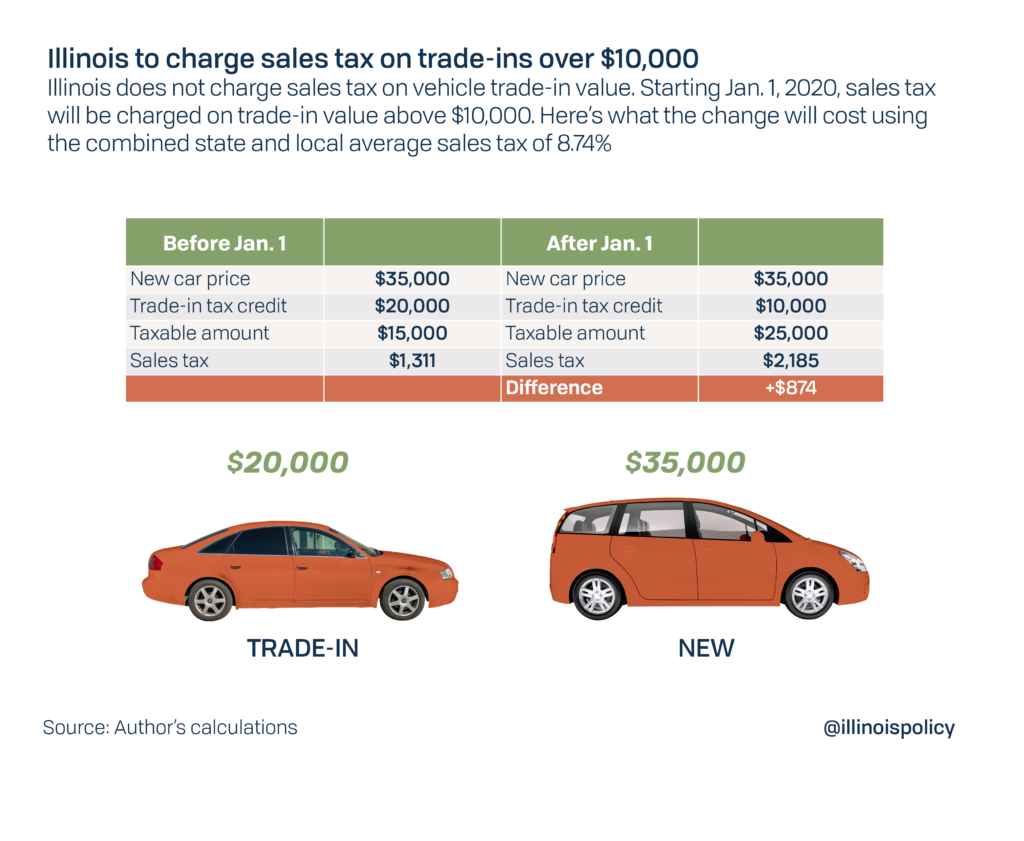

You will subtract the trade-in value by the purchase price and get 25000. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

There is also between a 025 and 075 when it comes to. There is also between a 025 and 075 when it. Form RUT-50 Private Party Vehicle Use Tax Transaction Return due no later than 30 days after the purchase date of the vehicle.

In addition to state and county tax the City of. Therefore your car sales tax will be based on the 25000 amount. If you are selling a car in illinois you must follow the following steps.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. When you sell your car you must declare the actual selling purchase price. The buyer will have to pay.

Although the buyer pays for this inspection the seller and buyer must agree on when and where the inspection is to be held. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. This tax is paid directly to illinois department of revenue.

How is sales tax calculated on a used car in Illinois. WHEN SELLING YOUR CAR Reporting a wrong purchase price is FRAUD. Arkansas House Bill would decrease car sales tax on.

Use the illinois tax rate finder to find your tax. As of January 1st 2022. Who pays sales tax when selling a car privately in Illinois.

The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle. It ends with 25 for vehicles at least 11 years old. It starts at 390 for.

For vehicles worth less than. There is also between a 025 and 075 when it comes to county tax. Illinois Sales Tax on Car Purchases.

If you buy a 1-year used model from a dealership for 14000 and the tax rate is 7 youll end up paying 980 in sales tax which is nearly 600 more than if you bought one. Form ST-556 Sales Tax Transaction. This tax is paid directly to the Illinois Department.

Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

How To Transfer A Vehicle Title In Illinois Dmv Connect

How To Transfer Car Title In Illinois Metromile

How To Get The Best Offer For Your Trade In News Cars Com

Title Jumping What Is Title Jumping When The Sellers Name Is Not On Title Its Dangers Sell My Car In Chicago

All About Bills Of Sale In Maine The Forms And Facts You Need

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

Leasehold Tax Trouble Cook County Governments Have Lost 88 7 Million Letting Tenants Skip Out On Property Taxes Chicago Sun Times

Suburban Families Could Pay 1 700 More In Vehicle Related Taxes Starting Jan 1

Important Tax Changes For Illinois Car Buyers The Driven Fiduciary

What Is The Sales Tax On A Car In Illinois Naperville

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Illinois Sales Tax Irv2 Forums

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation